💡 Founder Tip of the Month: Turn Cold Emails into Warm Conversations

A great quote I heard recently from a VC is: "show me you know me."

Cold emails don’t have to feel cold. The difference between being ignored and getting a reply often comes down to specificity and relevance.

Instead of sending a generic "Hi, I'm raising a round" message, try this instead:

Personalize the opener. Mention something real, like a recent investment they made, a podcast they were on, or a quote from their blog or Twitter. This shows you’ve done your homework.

Get to the point + have a "hook." In one line, say what you’re building and the traction you’ve got. “We’re a B2B platform helping SMBs automate invoices. Hit $20k MRR last month, growing 30% MoM.”

Explain why they fit. Tell them why you think they are the right investor (e.g., “We saw you led the Seed rounds for X and Y; we are working on similar problems.”)

End with a low-commitment ask. Something like, “Would love to show you what we're working on if you’re open to a quick call next week."

Pro Tip: Keep it under 100 words. Busy investors skim, clarity wins.

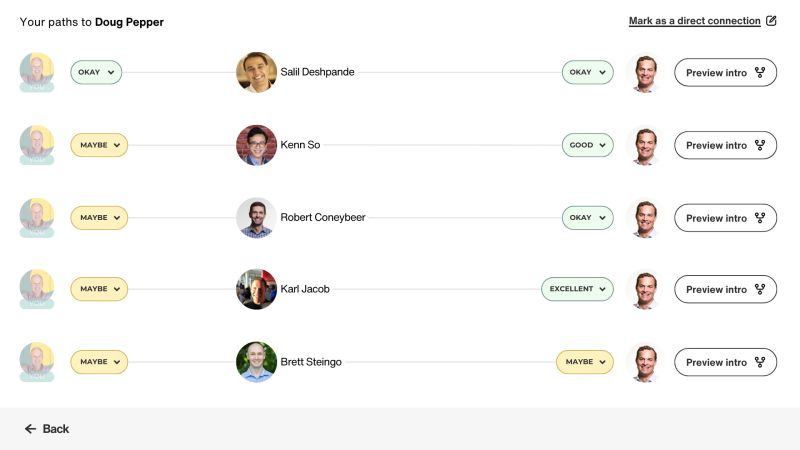

P.S: If you’re looking for intros instead of cold outreach, Foundersuite’s Warm Intro tool shows which of your LinkedIn contacts can connect you to the right investor, right from your CRM.

📚 Useful Reads

30 VC funds with FRESH capital to deploy right now

VCs Are Funding Two Things Right Now: Everything else? Down 63%.

How Much of Your Company Should You Expect to Sell in Each Round?

The Ultimate VC Glossary: 150 Terms Every Founder & VC Needs

Perspective for Startups 2025: AI represents an unprecedented opportunity for startups.

❓ Ask Foundersuite: Mini Q&A

Q: How many investors should I reach out to when raising a pre-seed round?

A: A good rule of thumb is to start with 100 - 200 qualified investors in your pipeline. Expect a ~5–10% conversion to serious interest (aka a term sheet), and aim to land 2–3 term sheets.

Don’t spray and pray, focus on relevance. Investors who back your stage, market, and model will always be more responsive. Yes, it takes time to research and qualify them, but it's amazing how much easier a fundraise will go if you are reaching out to people who are looking for your type of deal.

Q: Should I disclose other investors I’m speaking with during a fundraise?

A: Yes, strategically. Mentioning other VCs you're talking to (especially well-known names) can signal momentum and create subtle FOMO. But timing and context are key:

Early-stage: If you’ve just started, keep it general. For example, “We’re currently in conversations with a few funds focused on B2B SaaS.”

Once you have soft commits: Drop names (with permission) or phrases like “We’ve got strong interest from X and Y, and we’re aiming to close in the next few weeks.”

Don’t fake it. Investors know each other. If you bluff, it can backfire quickly.

Got a fundraising question you'd like answered in the next newsletter?

Email us at newsletter@foundersuite.com and we might feature it in the next newsletter!

🎙️ Short of the Week

How To Tell Your Story as a Founder -- The Three Questions Founders Have To Ask (And Answer)

Feedback? What do you want to see more of? Who should Nathan interview next? Email us at info@foundersuite.com

Mayar & the Foundersuite Team